The average citizens only use credit cards for purchases and savings, but the world’s elite have access to some exclusive credit cards that give them additional perks such as access to premium concert tickets, airline reward programs and many other benefits.

These prestigious credit cards are usually made from a very expensive material and you will probably need an invitation to get access to one of them, depending on your bank account. If you’re struggling to make your credit card payments, consider refinancing to pay down debt. One option for this is using car title loans to consolidate. Let’s take a look at the most exclusive credit cards throughout the globe right now.

10. Barclays Visa Black Card

The Black Card from Barclays is made of stainless steel and it looks absolutely beautiful. But it’s extremely exclusive since you have to prove you have a huge income putting you in the 1% richest persons in your country, just to get one. To keep the Black Card you have to pay $500 each year, but with this card you’ll have access to the VIP Airport Lounges, a $250,000 travel insurance, premium hotel access, concierge service and other rewards.

9. Citibank Ultima Card

Exclusive to Russia, Germany, the Middle East and some parts of Asia, the Ultima Card can be received only by invitation and when it comes to travel, it has you covered since you get 120,000 points when you get it. You get rounds of golf whenever you want them for free, access to the airport lounges, exclusive hotel deals and when it comes to travel, you can have your own Bentley, private jet or yacht at your disposal in less than 10 hours!

8. Merrill Accolades American Express Card

Of course, you have to be a client of the Merrill Lynch Wealth Management division to get one of these cars and even then you only get one if you’re invited. The fee for the card is only $295 and given that you have to earn at least $200,000 a year to get one, you won’t even feel it. The bull of the Merrill Lynch logo is on the card in golden colors and by just waving this card you have hotel discounts, complimentary amenities at resorts, full time concierge service, access to airport lounges and airline discounts.

7. Coutts World Silk Card

If they need to earn at least $200,000 per year for a Merrill Accolades Card, this one is five times more demanding since you just have to keep $1 million in the bank account just to get it. It is the card used by Queen Elizabeth II and thus it’s fit for royalty, carrying an annual percentage rate of 49.1% and giving you airport lounge privileges, travel insurance, concierge service and purchase protection. Of course you still have to wait for an invitation even if you have the million waiting in a Coutts account.

6. Stratus Rewards Visa Card

This one chose white as its color instead of the more typical gold or black tones and it is available by invitation via a current card member or the Stratus Rewards partner company. This exclusive VISA card was designed for wealthy consumers who usually travel by private jets. The annual fee is of $1,500 and the members can pool their earned points of jet travel and redeem flight hours on the private jets of the MarquisJet Company. The discounts, complimentary car service, upgrades, amenities at luxury hotels and concierge service are available as well and you can redeem points for consultation with lifestyle experts, but you don’t really need them since Luxatic is the only lifestyle expert you could wish for.

5. Black Brazilian MasterCard

If you had to be in the 1% richest people of the country to get a Black Card in America, the Brazilian version is even more demanding since you have to be one of the 3,000 richest persons in the country, which is way less than 1% in a country with 200 million. The members of the Santander Group private bank receive it through invitation and it is not clear what is the amount needed in the bank account to qualify. As the perks offered to you there’s the usual worldwide airport lounge access, concierge service and discounts on private jets, all for an annual fee of just $350.

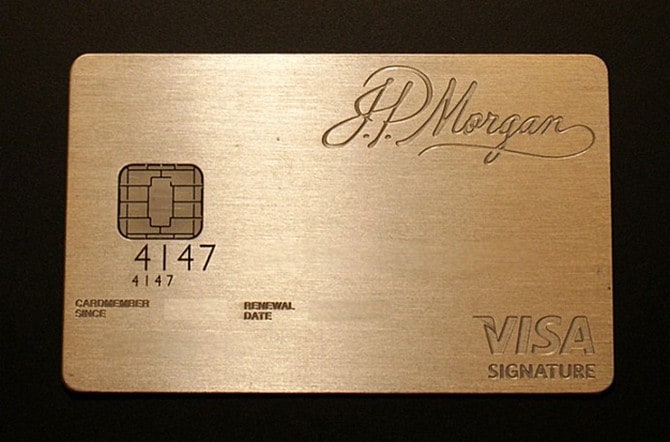

4. JP Morgan Chase Palladium Card

This wonderful card from JP Morgan Chase will surely stand out since it is made of palladium and gold with laser etchings. It was created almost ten years after American Express Centurion Card and the worth of the card itself is $1,000 due to the precious metals on it. With an annual fee of $695, it is rumored that you must have $25 million invested with JP Morgan Chase to receive one. Aside from the private jet discount, hotel upgrades, events access and concierge service it also rewards you with 35,000 points if you spend over $100,000 in a year and there is no spending limit.

3. Visa Infinite Card

It was entitled infinite but it just lets you get $15,000 each day from any ATM in the world. You can get half a million with your card if you go to a bank branch and you only need to make $100,000 a year to get one of these cards, meaning that you will have to work quite a bit to pay the credit. The point of the card is to allow you easy access to money throughout the globe and it can be issued in countries like Jordan, Russia, South Africa, Canada, France or Luxembourg with different requirements in each of the countries to receive an invitation. You have to pay a different sum as well depending on the country, but each of them allows concierge service, premium hotel accommodations, access to exclusive events and travel recommendations.

2. Dubai First Royale MasterCard

Exclusive to the United Arab Emirates, this impressive card has no annual fee and there is no spending limit either. When it was first created, it was only given to the 200 richest customers of the Dubai First Bank and it’s extremely difficult to get one to this day due to the amazing perks it offers. “You ask for the moon and we try to get it”, says Ibrahim al Ansari, the CEO of Dubai First, which gives you access to lifestyle managers that basically make sure you get everything you need. There is no credit limit and no restrictions with this card so the look has to follow suit and thus it has a .235-carat diamond in the center with a black tone around it and two gold edges.

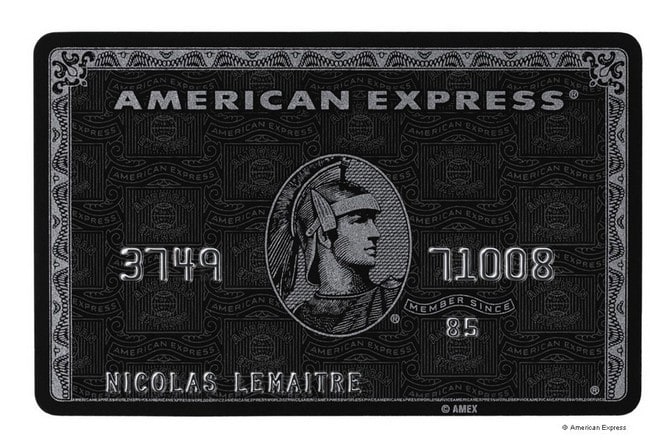

1. American Express Centurion Card

The Centurion card from American Express has been the most desired credit card in the world, ever since it was first issued, back in 1999. Made from titanium, this sleek black card is a lot heavier than any other credit card. You can’t really apply for the Centurion Card, you just need to spend at least $250,000 every year to get an invite to the exclusive club from American Express. The card itself costs and additional $5,000 and of course, there is the annual fee of $2,500. Once you have the titanium card you receive concierge service, complimentary hotel rooms, personal shoppers, flight upgrades, airport lounge privileges and no spending limit.

Contents