If you follow the luxury goods industry as either an investor or an interested consumer, there’s no denying that 2020 was an interesting year. The sector changed in profound ways, faced historic challenges, and is continuing to morph into some former version of itself in this post-pandemic world.

For investors who focus their attention on trading gold futures, it’s worth watching these changes unfold. Some, especially those related to the jewelry industry, can play a significant part in determining when to make a move in the yellow metal’s futures markets.

Overall, the key takeaways about how luxury trends changed in 2020 include a new definition of what a typical consumer is, how the COVID plague pummeled high-end product sales, how jewelry has survived and thrived, and more.

What Happened in Early 2020?

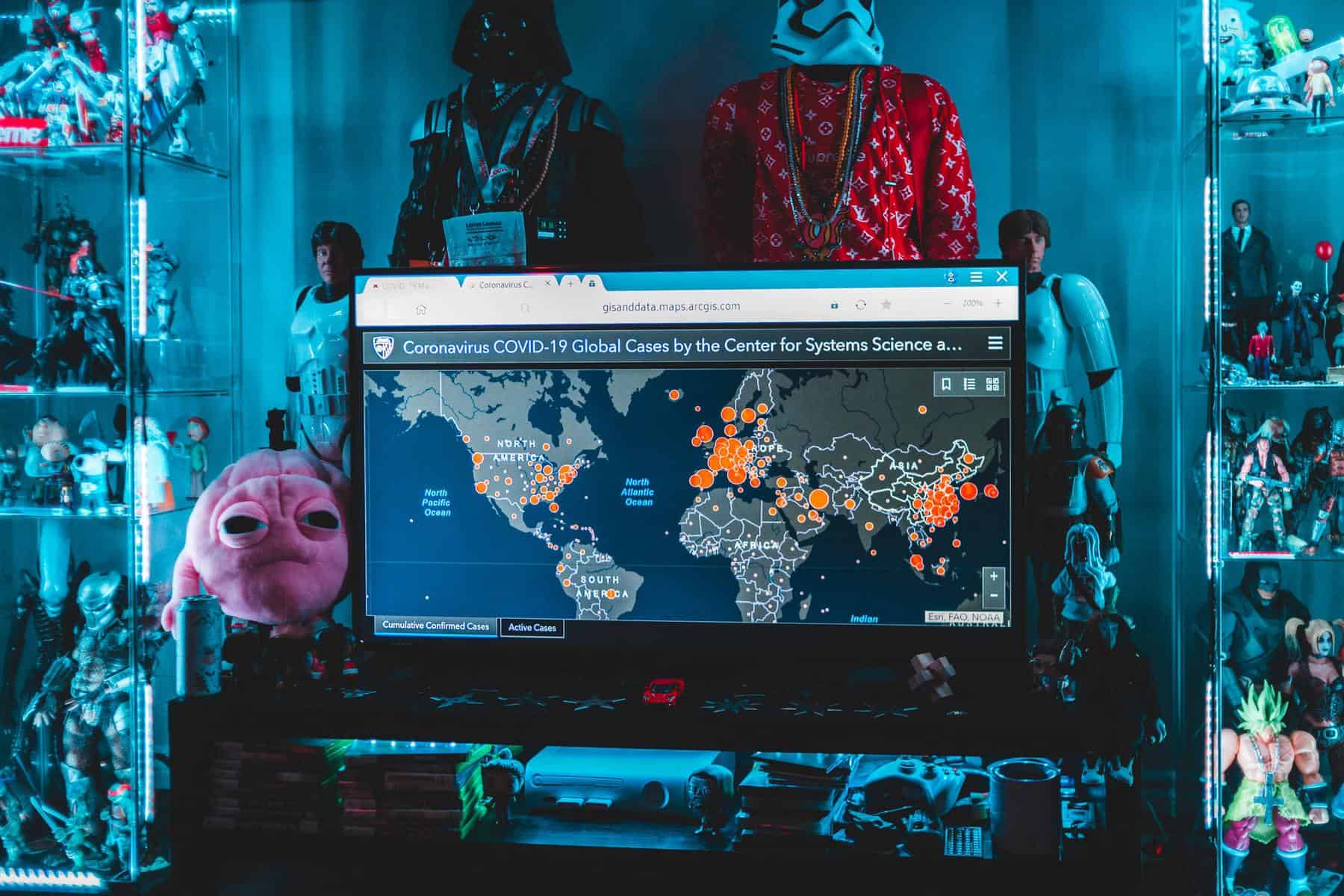

When COVID spread across the world, every financial market was deeply affected. Out of this negative scenario there have been at least a few positives. A shift toward e-commerce has been one of them.

What people can’t acquire in person they can order via a website-based shopping cart. In fact, it already looks like the pandemic might have acted to accelerate a huge move toward at-home, computer-based consumerism.

Is There an Average Customer?

Getting a read on the typical buyer in any segment can yield plenty of worthwhile information. How have buyers of high-priced, exclusive items changed? They’re younger, for one thing. They also don’t care as much about showing off their purchases. For at least a decade, there’s been a shift is the demographic that makes up the primary buyers of luxury goods.

People born after 1981 constitute about one-third of all buys of high-end goods. Within the next four years, they’ll represent at least half of such customers. How are these younger folks different?

For starters, they prefer to purchase items with celebrity tie-ins and often expect to resell the things they buy. That’s a huge contrast from previous eras, when people who bought exclusive goods kept them forever, perhaps passing them to children in wills and estate transfers.

Another way these new age buyers are different, they have no problem acquiring used products as long as the quality is still there and there’s no risk of getting a fake. Perhaps one of the most important differences between the new generation of customers and previous ones is they are more interested in an exclusive experience than in a thing.

This single point has wide implications for sellers, investors, and policy makers. It means we can expect millennials to seek fine dining, fancy travel, exotic entertainment events, and fine art more than costly sneakers, name-brand bags, and leather outfits.

How the COVID Virus Slammed the Global Luxury Markets

When all the dust settles, it’s highly likely that the virus will end up chopping down about one-fourth of the worldwide luxury-goods market, at least temporarily. One of the main reasons for the speed with which the pandemic affected the segment is related to where the disease began.

Chinese consumers purchase the majority of high-end goods, and their country was the one in which COVID originated. That meant a massive number of direct buyers were instantly taken out of the equation, this pummeling overall global demand for exclusive products and services.

In Europe, the U.S., Canada, Mexico, and China, brick and mortar retailers were forced to shutter their stores for several months. That led to hundreds of millions of consumers stuck in their homes with no shopping centers, boutiques, or sales floors to visit, wallets in hand. Even worse, 2020 will forever be known as the year in which long-distance travel become virtually impossible for most people.

For high-priced items, that’s a poisonous recipe because travelers spend big on pricey goods and services. Vacationers traditionally fork over huge sums for gifts while traveling, whether the points of sale are on ships, resort towns, duty free shops, train stations, or airports.

The Interesting Case of Gold and the Jewelry Market

Year after year, and even in the COVID era that began in early 2020, gold does double-duty as an investment vehicle and a major component of fine jewelry. Another annually repeating trend is that about half of all the yellow metal produced is used in the jewelry industry. About one-third is considered investment metal, and the rest is either bought by central banks or used by the tech industry.

For everyday traders who want to make a profit on the world’s favorite precious metal, there’s a sort of built-in stability when approximately 80 percent of it is essentially on a perpetual consumption cycle, nearly guaranteeing long-term and short-term demand.