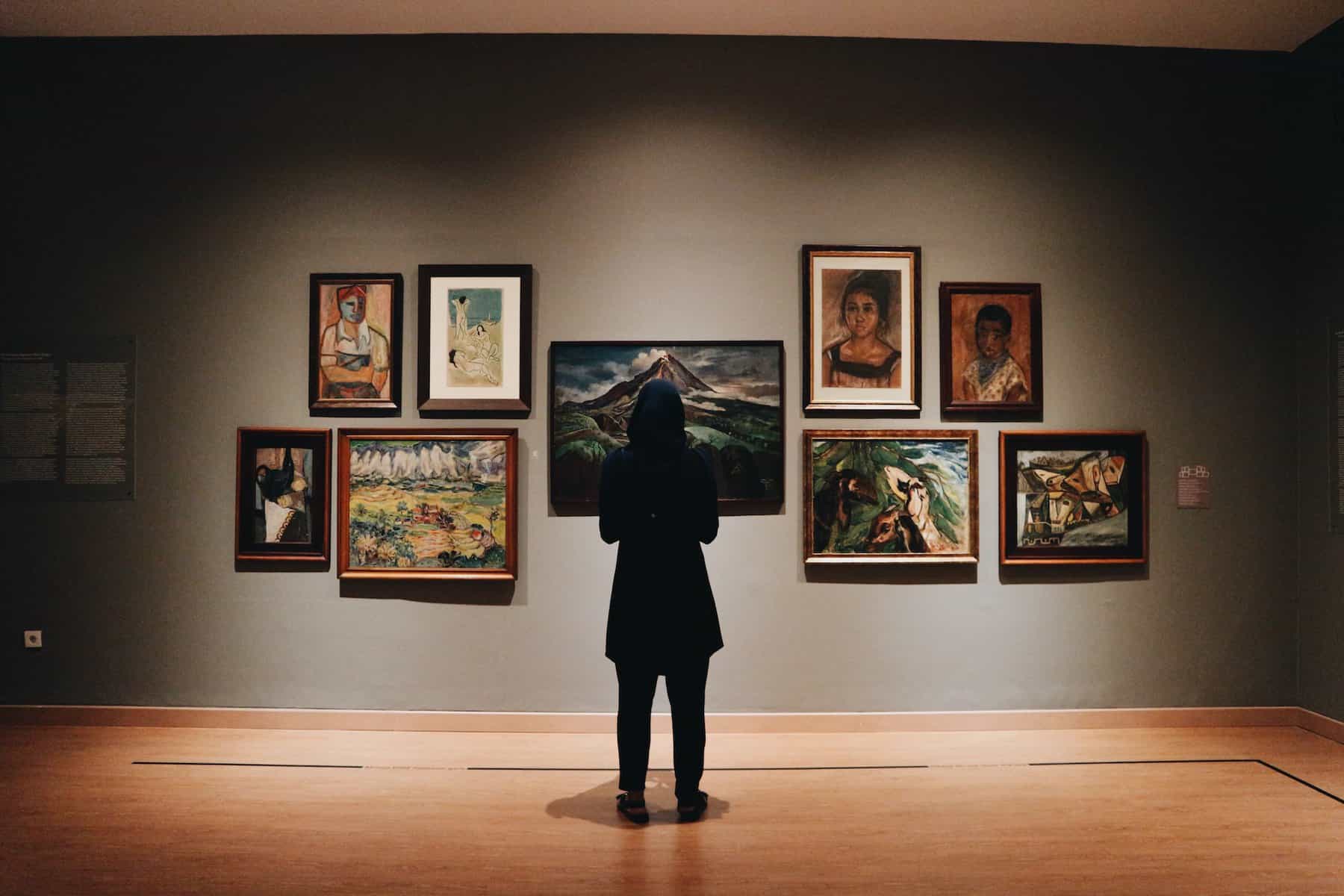

As anyone who’s into luxury goods, travel, and vehicles can tell you, those things aren’t cheap. Luxury buyers sometimes have to choose between their passions, so they can actually afford the things they love most.

However, when you’re dealing with multimillion-dollar luxury items, like paintings by generational masters, sometimes there just isn’t enough money to make even one purchase.

The root of the problem is that valuable paintings are, well, valuable. So fine art lovers who don’t have millions of dollars to spend have little choice but to sit on the sidelines while the art they love to own gets sold to the highest bidder. But what if there was a way for any fine art lover to own the art they love without spending money they don’t have?

It turns out that there is a way to do it – by purchasing fractional shares of fine art. It’s a form of collective ownership that can work as both a means of building an art collection as well as a lucrative investment opportunity. And it’s exactly what an innovative company called Masterworks allows you to do.

Here’s how it works, as compared to the traditional art investment process.

The Typical Fine Art Investment Process

Ordinarily, the way an individual investor would invest in artwork is to attend an auction or private art sale to bid on and hopefully acquire a piece of fine art.

To get that far, however, the investor would need to build up their expertise in the art market first and identify works of art that seem to have decent prospects for appreciation. That’s the kind of knowhow and “touch” that can take many years – and hundreds of thousands of dollars – to complete.

Then, the investor would still have to raise the money to make a purchase. That represents another significant barrier to entry, as a desirable and investment-worthy work of art can cost hundreds of thousands or even millions of dollars on its own.

As a result, you won’t find anyone other than high-net-worth individuals participating in fine art investing in the traditional way. And the available data bears that out, with Knight Frank’s The Wealth Report 2023 indicating that art investments were a top performer for ultra-high-net-worth individuals in 2022.

How Masterworks Serves the Average Investor

Fortunately, Masterworks helps the average investor to bypass the high barriers to entry in the fine art investment space. They do so first by eliminating the need for an investor to turn themselves into an art expert before getting into the market. Instead, Masterworks maintains a staff of experts in the disciplines of art evaluations, valuations, and sales, just like a high-end auction house like Christie’s might.

Those experts work to locate artwork that has a high chance of appreciation, making it suitable as an investment asset. Then, they handle the work of purchasing the artwork itself to hold on behalf of investors. With the artwork secured, Masterworks then files an offering circular with the US Securities and Exchange Commission, advertising shares in the artwork for sale to the public.

That’s the point where the average investor can get involved, by purchasing shares in the artwork held by Masterworks. With shares on offer for as low as $20, it’s simple to get started co-owning a work of fine art. Owners of shares can then trade them with others on Masterworks’ on-platform trading market. Or, they can wait for Masterworks to sell the underlying artwork, hopefully for a profit, after a few years of holding a given piece.

Your Investment Prospects

Like all other investment types, there’s never a guarantee of success. However, Masterworks has an excellent reputation in the art and investment worlds. In its years of operations, Masterworks has offered double-digit return percentages in all but two years, with its worst annual return falling to a still-respectable 4.1%. They even boasted one painting with an insane 325.5% annualized return – which is unheard of in other investment markets, sans the heady early days of the crypto craze.

Those strong returns are possible for a few simple reasons. First and foremost is the expertise of Masterworks’ 200-plus employees. The company’s proprietary database allows them to track trends that others might not notice, and the results speak for themselves.

The investment returns are also possible because the art market is the domain of the ultra-rich. And whenever there are huge amounts of money pouring into an investment market, massive price appreciation often follows, even when other asset classes trend downward. In other words, it’s a case of a rising tide lifting all boats.

Perhaps this is why statistically, fine art prices have little correlation to other asset classes during recessions and other economic headwinds.

In fact, contemporary fine art has exhibited the second-lowest number of two-year depreciation periods of all investment classes, along with the highest compound annual growth rate (CAGR) since 1995. That’s about as great a performance as you can expect from any type of investment.

Making Fine Art Ownership Accessible

There you have it. Now you know that it’s possible to purchase a piece of a high-value painting to use as an investment vehicle without being ultra wealthy to begin with. It’s an excellent way to improve your financial prospects so you can finance the luxe life you want. Plus, you’ll gain the cachet of being able to tell your friends that you own a Jean Michel Basquiat or a Carmen Herrera, and what’s more luxe than that?