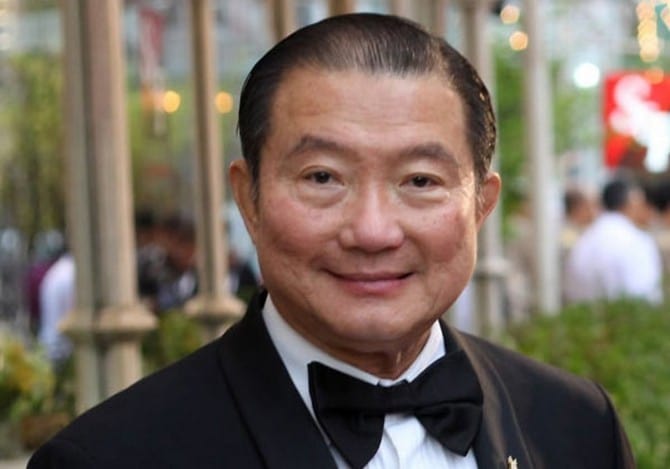

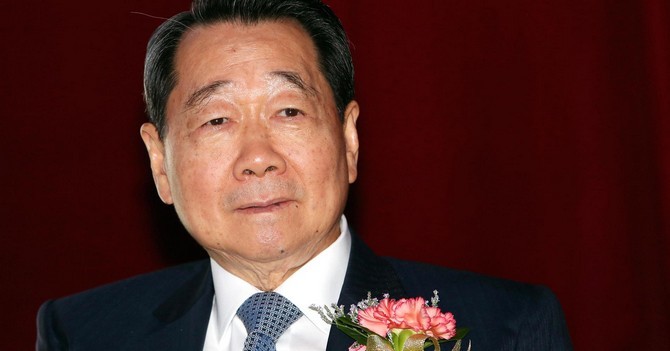

The business magnate and investor Charoen Sirivadhanabhakdi was born on the second of May 1954 as the sixth child of a poor street vendor who migrated from Shantau in the south side of China to Bangkok, Thailand.

His family consisted of eleven children and thus Charoen had to leave school from an early age (when he was nine years old!) to work and help support himself. He was supplying for the distilleries that created the local brand of Thai whiskey and were run by the state at the time.

The job helped him create connections in the industry and in the end he managed to acquire a license to create his own alcoholic drinks. Since at the time all liquor production was owned by the state, the fact that Charoen managed to receive rights for 15% of the market was a really big achievement and it was only in 1985 when the remaining 85% of the licenses were opened to bids.

At this time his large stocks of alcohol allowed him to put them up as collateral to receive a loan of $200 million and this was sufficient for him to win 100% of the concessions, giving him the monopoly for liquor production in the country. The companies returned $550 million as royalties to the excise department two years later, which consisted 5% of the national budget.

The original name of Charoen was Khun Charoen and it was only in 1988 when the King of Thailand granted him the family name Sirivadhanabhakdi. He was decorated several times after this receiving the Knight Grand Cordon special class, first class, The Knight Commander Second Class Lower Grade and The Knight Grand Cross First Class royal honors.

The beer market in the country was growing and thus Carlsberg sought Charoen for collaboration in 1991 to bring a competing product to the Singha beer produced by Boon Rawd Brewery which was at the time the leading product. The deal was that Charoen’s brewery would make Carlsberg and the sales as well as marketing networks would be used for his Thai whiskey.

The exchange of experience benefited Charoen immensely and he started to produce his own beer three years later. It was entitled Chang, which means ‘elephant’ in Thai. This beer was more potent than Singha, cheaper and was heavily marketed.

With the savvy marketing it was quickly accepted by the population and in five years it managed to cover 60% of the local market, leading to the withdrawal of Carlsberg from the joint venture in 2003. Charoen sued the Danish company after a dispute with a brewer he controlled that was finally settled in 2005 and led to him gaining $120 million.

In 1986 the Surathip Group, which was the distributor of Chang beer owed around $40 million to the banks and $190 million to the state and during the early 2000s a scandal ensued when the former military general and prime minister of Thailand Prem Tinsulanonda helped the company gain the monopoly it had over the liquor industry through the restructuration of contracts in order to reduce the “burdens” Charoen had to pay.

Another accusation was made when the Asian financial crisis of 1997 allowed Charoen to use his political connections to expand his dominance over the alcohol industry and he was able to put pressure against the liberalization of the whiskey market through the rescuing of hundreds of Thai companies that were struggling but were politically connected. The crisis was a thing for him to exploit, buying land and property at low prices and at the same time increase his political connections.

With the new capital Charoen branched out with the creation of TCC Land Co Ltd., a company involved in property development that became one of the largest in Thailand. It invested in residential, hospitality and retail sites while also developing new ones and covered property management, logistics, agro-business and different property funds.

With this project Charoen is the largest landlord in the country having three times more than the second largest landowner in Thailand. Aside from the properties owned in the country it also controls property funds in Singapore and has interests in the US, UK, Australia, Japan and some of the other countries in South East Asia.

He mostly keeps a low profile along with his wife Khunying Wanna who helps him run the empire and they have five children together. The son Thapana Sirivadhanabhakdi is the CEO of ThaiBev and the daughter Wallapa is the executive director of TCC Land, while the youngest son Panote is a member of the board executive committee of F&N.

Each of his children received the top education possible overseas but today they still live with their parents in the ten floor family compound in the center of Bangkok. Their charity donations are mostly done anonymously by the family, so it is hard to estimate the philanthropic involvement, although they assure us it is there.

Despite his low profile he became a figure of headline in 2004 when he tried to buy the Liverpool football club. Although the attempt failed he managed to get a sponsorship deal with Everton. A year later though, a bigger headline landed with the announcement that he would float ThaiBev at the Bangkok Stock Exchange and some protests arose forcing him to shift the listing to Singapore.

He won the bid for the Fraser & Neave Ltd. Singapore branch in 2013 and this gave him access to a lot of properties throughout the continent as well as operations in the field of soft-drinks. So he wasn’t just dealing with hard liquor at this time, he expanded into all beverages. The financing to make the deal led to the largest merger-and-acquisition transaction done in Asia in 2012.

The negotiations for Fraser & Neave took six months and the patience learned after over 50 years in the business environment of Thailand, combined with the determination of Charoen was what finally won him the prize, making him a significant player in the region. With and estimated worth of $13 billion and at the age of 71, Charoen is still on the rise and now started talks to buy the stake of OCBC in the United Engineers, listed in the Singapore stock market.